Title: Impact of Covid-19 on US and China

Category: Coursework

Sub Category: Research Essay

Subject: International Economics

References: APA

Corona pandemic:

Advent of 21st century has resulted in catastrophic impact on global public health as the world has experienced several epidemic in the form of SARS epidemic in 2002, H1N1 pandemic in 2012, MERC epidemic in 2012, EBOLA epidemic in 2014 and now COVID-19. COVID-19 which is an emerging infectious disease has emerged as a global epidemic effective more than 190 countries around the world. On 11th March, 2020, World Health Organization (WHO) has declared Corona virus as a global pandemic. (Anjorin, 2020) According to the recent statistics from World Health Organization (WHO) Covid-19 has effected more than 4.3 million people around the world and resulted in death of 289,345 people whereas 1,547,274 have recovered from the disease. Wuhan, China has been declared the epicenter of the virus as many believes that the virus has been spread from the seafood market in Wuhan. However, the virus has propagated to other countries around the world becoming a global threat as majority of the country were not prepared for this pandemic. As a consequence, many hospitals around the world have become over crowded with patients due to skyrocket increase in the spread of disease. In response to the emerging situation, many countries have introduced strict measures which includes practicing of social distancing and restriction on public movement on the top of closure of airports, schools, restaurants, bars and shopping malls. Restrictions imposed by government on citizens leaving their houses has resulted in major economic downturn as stock markets are crashing, demand for oil is decreasing, businesses are filling bankruptcy and millions of people are unemployed. (Stojkoski, Utkovski, Jolakoski, Tevdovski, & Kocarev, 2020) This crisis have resulted in far reaching impact on global dynamics effected all aspects of life including economy, social, culture and politics. More than 191 countries around the world have reported nationwide closure of all economic and educational activities around the world with catastrophic impact on global economy.

According to (Boissay & Rungcharoenkitkul, 2020) Covid-19 has emerged as the most serious global health crisis after the Spanish flew in 1918. Indeed, Covid-19 has proved to be most cost pandemic in recent history resulting in trauma across major financial markets across the world. Synchronized response of government around the world in the form of lockdown and social distancing has resulted in unprecedented economic recession as stringent containment policies have significantly affected the economic transmission channel.

Current international economy after corona pandemic:

International economy has been disrupted at numerous front resulting in unprecedented rates of unemployment as China reported 5.9% unemployment rate, Australia reported 5.2% unemployment rate, Germany reported 5% unemployment rate, US reported 4.4% unemployment rate and South Korea reported 3.8% unemployment rate. Pandemic has effected both manufacturing and service sector around the world but the severe impact of Pandemic is on Service industries which has resulted in the decreasing growth rate of 6.5% reported by US and 15.8% reported by China. Many stable economies relied on their service sector which has reported significant downfall in revenues and sales forcing many enterprise. All regions around the world reported significant decrease in merchandise trade effective import and export activity. IMF has reported 3% decrease and shrink in global economy suggesting that the cumulative loss of GDP in 2020 and 2021 will be more than 9 trillion dollars which is greater than the GDP of Japan and Germany. (Lee, 2020)

Capital markets on the other hand reported worst year in history after 1987 as DOW and FTSE reported largest drop in history after 1987 as a result many countries around the world has decreased the interest rate as a macroeconomic measure to overcome the fear of recession and stagflation. More than 30 mission people around in US only has filed for unemployment benefits whereas oil prices have been crashed by 20% due to the decrease in demand of oil. It was an event of history when US oil prices turned negative despite the fact the OPEC and other countries have agreed to cute the production of crude oil. International trade activity has been slashed as more than 100 countries around the world have imposed travel restrictions to contain the spread of virus which has resulted in significant losses for air travel industry. (Jones, Palumbo, & Brown, 2020)

Covid-19 has caused substantial output contraction as economic uncertainty has resulted in negative impact on business environment and investment caused by higher transactional cost bringing world economy at standstill position. Containment measures taken by government have resulted in downward pressure on global GDP which poses catastrophic consequences on poverty as people living under poverty line will increase from 85 million to 420 million.

[Acquire Top-notch Coursework Writing Service From Expert’s And Improve Your Academic Performance]

The impact of the pandemic on USA AND CHINA:

Impact of Covid-19 on China:

China being an epicenter of the pandemic is the hardest hit country which has resulted in 20% decline in industrial production. Being an epicenter of virus China is ahead of many other countries in the virus progression curve. To this date 12 May, 2020, China has reported more than 82,919 with the death toll of 4,633 whereas 78,171 people have been recovered from the infection. Virus spread in China has resulted in ripple effects throughout China and beyond. In response to tackle the crisis, China has closed 70 000 movie, cancelled thousands of flights and disrupted all tourism activity in mainland. Economic impact of the virus has extended beyond the Hubei province to the entire mainland and world as China contributes to approximately 16.3% of the entire GDP worldwide. Slowdown in Chinese economy have send waves of uncertainty throughout the world. (Ayittey, Ayittey, Chiwero, Kamasah, & Dzuvor, 2020)

Government in China have imposed several weeks lockdown which has resulted in sharp decrease in factory output, retail sales, construction industry and other economic activity. China economy has been dipped by 7% of GDP during the first quarter of 2020. In response to the crisis China has double 60% of its government debt and has been spending aggressively to contain the economic impact of crisis. (Masters, 2020)

China financial markets are significantly affected by the novel corona virus as Shangai composite index has fell by 7.7% with loss of $375 billion decline of market value in one day. Shenzhen Composite Index on the other hand reported decline of 8.4% in value. More than 11 provinces in China are in the state of partial lockdown which accounts for two third production of automobile in the country with the loss of loss of about 350 000 units. On contrary, to the manufacturing sector service industry of China has been affected to great expect as China reported significant decrease in inbound and outbound tourism as more than 6.3 million Chinese travels overseas for vacations during Chinese New Year have resulted in loss of $73 billion to the global tourism market. (Ayittey, Ayittey, Chiwero, Kamasah, & Dzuvor, 2020)

Impact of Covid-19 on United States:

United States is one the largest economy in the world and has emerged as a largest victim of the virus as US reported catastrophic figures of death toll with more than 140,000 Americans who are confirmed infected in March, America is now approaching towards 650,000 cases of infections with more than 3,000 fatalities have already occurred in the U.S.. This poses significant implication on healthcare but wider impact on economy as it has affected American economy at unprecedented force and speed. US stock markets have sunk quarter and wiped out three years of gain as 3.28 million Americans applied for unemployment an benefit which is highest in the history of United States (US). Effect on US economy is different from China as corona virus has significantly decreased consumption activity as America economy relies on consumption which accounts for 70% of the GDP which has been effected to large extent as businesses are closed and household purchase are disrupted. Investment accounts for 20% of American GDP which has been severely affected until further clarification of cost of Covid-19. Lastly, manufacturing accounts for 11% of the GDP which has been severely effected as many big companies such as Ford and GM have announced temporarily closure of their factories. (Miller, 2020) Industries which are hardest hit by the Covid-19 includes hospitality, aerospace, travel and insurance.

International finance after corona crisis:

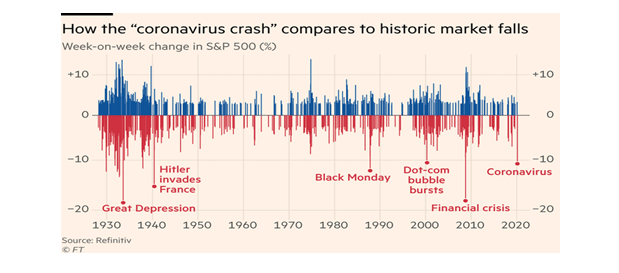

Corona Virus has effected international financial markets as it has left more than millions of people out of work. Prices of major corporations of world has plunged squeezing debtors everywhere around the world. All financial markets are limiting exposure to open trade as a result investors around the world are concerned as stock markets around the world have suffered trillions of US dollar in losses as US stock loss is nearly 12% with $3.5 trillion was erased from listed stocks< MSCI world index is down by 12%, STOXX 600 index fell 3.5%, Shanghai composite was down 3.71% and Nikkei 225 dropped 3.67%. Historic Market Falls” graph lists Covid-19 crash as a historic era of history wiping $5 trillion from global economy as showed in graph below. (Obeid, 2020)

To combat these circumstances, three measures at least needs to be taken. Firstly, the contract-basis payments of all citizens such as credit card debt, mortgage debt or student loans etc. should be suspended for 12 weeks or more depending upon the period of the lockdown. This can be considered as the ‘bank holiday’ and post-holiday there should be no urgency demands of the banks to overcome the previous payments. Secondly, there should be provision of income support for the citizens who have less than $50,000 savings. They should be made eligible to receive at least $1000 fortnightly payment from the Treasury to support themselves during the lockdown. Thirdly, the health support must be free of cost and without any discrimination. All the healthcare providers should treat their patients irrespective of their financial status. Furthermore, there have to be some side measures to compensate for the measures made to meet the demand ends. First of all, the production of essential supplies, such as medical supplies, foodstuff, electricity and water supplies etc., shall be continued in order to meet the needs of the citizens. For this purpose, all precautionary measures should be taken to allow the workers to work in a safe environment where they should feel protected, this includes provision of free face masks and hazmat suits. Second of all, the duration for this pandemic to end is still unknown thereby, the stocks for supplies such as medical protective equipment, food items and fuels etc. should be stocked up in forms of piles in specific areas that should last enough for weeks. Lastly, if a domestic production of any given item is insufficient in a country then, they should consider exemptions from Tariffs and other import restrictions. As in this time, survival is the key to succeed (Hocket, 2020).

On the other side of the picture, the Federal Reserve of US has already taken actions against the downfall of economy by slashing the interest rates in between 0.25% to 0.5%. Although the chances of having inflation are low as the prices of crude oil have been dropped drastically with provided conditions of long-term bond rates and a wider market. But the fear of inflation still remains a terrifying condition for all. The annual wage growth in US is found to be just 3% but the present scenario dictates that attractive salary offers would have to be made to make people work in the retail markets, for instance Walmart, where the fear of contracting the virus is present. The current situation needs to be handled with care and wise decisions otherwise the interest rates will be increased resulting in a supply shock. Thus, there is a dire need to stop the incremental rise of buying long term treasury and selling of short term treasury. Furthermore, the slow growth is considered a threat that is bigger than inflation itself. It is quite obvious that the reputation of a brand matters a lot in its annual sale. So, if any brand increases the prices of its product in a health crisis state, it will impact its brand name in the longer run (Paul & Monica, 2020).

[For Any kind of Professional Essay Assistances From Expert’s. Send Us a Request to ‘write my essay‘ ]

REFERENCES:

Anjorin, A. A. (2020). The coronavirus disease 2019 (COVID-19) pandemic: A review and an update on cases in Africa. Asian Pacific Journal of Tropical Medicine.

Ayittey, F. K., Ayittey, M. K., Chiwero, N. B., Kamasah, J. S., & Dzuvor, C. (2020). Economic impacts of Wuhan 2019‐nCoV on Chinaand the world. Journal of Medical Virology .

Boissay, F., & Rungcharoenkitkul, P. (2020). Macroeconomic effects of Covid-19: an early review. Bank for International Settlements .

Jones, L., Palumbo, D., & Brown, D. (2020, April 30). Coronavirus: A visual guide to the economic impact. Retrieved from BBC: https://www.bbc.com/news/business-51706225

Lee, Y. N. (2020, April 24). 7 charts show how the coronavirus pandemic has hit the global economy. Retrieved from CNBC: https://www.cnbc.com/2020/04/24/coronavirus-pandemics-impact-on-the-global-economy-in-7-charts.html

Masters, J. (2020, May 04). Coronavirus: How Are Countries Responding to the Economic Crisis? Retrieved from CFR: https://www.cfr.org/backgrounder/coronavirus-how-are-countries-responding-economic-crisis

Miller, C. (2020, March 30). The Effect of COVID-19 on the U.S. Economy. Retrieved from FPRI: https://www.fpri.org/article/2020/03/the-effect-of-covid-19-on-the-u-s-economy/

Obeid, H. (2020, March 09). The impact of coronavirus on the financial markets. Retrieved from theconversation: https://theconversation.com/the-impact-of-coronavirus-on-the-financial-markets-133183

Stojkoski, V., Utkovski, Z., Jolakoski, P., Tevdovski, D., & Kocarev, L. (2020). The socio-economic determinants of the coronavirus disease (COVID-19) pandemic. SSRN Electronic Journal .

Hockett, R. (2020, March 17). Managing Coronavirus’s Economic Fallout—Demand And Supply Side Measures. Forbes. https://www.forbes.com/sites/rhockett/2020/03/16/managing-coronaviruss-economic-fallout-demand-and-supply-side-measures/#3f93ef15c219

Paul R. La Monica, CNN Business. (2020, March 10). The coronavirus economic ‘disaster’ scenario: Stagflation. CNN. https://edition.cnn.com/2020/03/10/investing/stagflation-economy-coronavirus/index.html